Important Updates

- The most important update to the Canada Emergency Wage subsidy program is that it’s been extended till August 29, 2020. Originally, the program was available from March 15, 2020 till June 6, 2020.

- The Canada Revenue Agency (CRA) will introduce a process to amend errors in the submitted CEWS claims.

- Employers won’t be required to reduce their CEWS claims by the eligible 10% Temporary Wage Subsidy for Employers (TWSE) if an election is made.

- An employer claiming the CEWS can now elect not to claim all or a portion of the TWSE. More information is available on the CRA’s frequently asked questions (FAQ) page.

- The CRA’s FAQ page now shows a list of prescribed organizations that are considered eligible employers.

- It also provides additional information for partnerships with complex ownership structures.

- Additional details along with a wage subsidy calculator is available on the CRA website here.

Summary of the Canada Emergency Wage Subsidy (CEWS) Program

- It is available on eligible remuneration paid to eligible employees in respect of work between March 15 and August 29, 2020 equal to the greater of:

- 75% of remuneration paid, up to a maximum of $847 per week and;

The lesser of:

- The amount of remuneration paid up to a maximum of $847 per week; and

- 75% of the employee’s pre-crisis weekly remuneration.

- Special rules apply to non-arm’s length employees. They can only avail this subsidy if they were employed before March 15, 2020. These rules have been put in place to prevent businesses from hiring or increasing the salaries of non-arm’s length employees so that they can receive more entitlements under CEWS. The subsidy for these employees will be limited to the lesser of:

- 75% of the employee’s pre-crisis weekly remuneration: or

- A maximum subsidy of $847 per week

- This also applies to retroactive wages paid to employees who were laid off and then rehired.

- The maximum benefit available per employee is based on $1,129 of weekly paid salary or wages ($58,700 annualized).

- There is no overall limit to the subsidy amount that an eligible employer can claim.

- Employers will also receive a refund of the employer portion of Canada Pension Plan (CPP) and Employment Insurance (EI) in respect of wages for employees on paid leave.

- The subsidy is taxable to the employer in the period received.

- Eligibility requirements for the 75% wage subsidy differ from the 10% temporary wage subsidy which was announced on March 18, 2020.

- For employers eligible for both the 75% CEWS and the 10% TWSE in the same period, the benefit received under the TWSE will reduce the amount claimed under the CEWS.

- The amount of CEWS paid is also reduced by amounts received through Employment and Social Development Canada’s (ESDC) Work-Sharing Program.

Definitions

1.Eligible Entity (Employer)

- This includes individuals, taxable corporations, and partnerships consisting of eligible employers, non-profit organizations, registered charities, and prescribed organizations.

- Public bodies are not eligible for this subsidy unless they meet the definition of a prescribed organization.

2.Eligible Employee

- An individual who should be employed in Canada.

- Within a qualifying period (given in the table below) and did not have 14 or more consecutive days without remuneration from the employer.

3.Eligible Remuneration

- Eligible remuneration includes salaries, wages and other remuneration. It does not include severance pay, or items such as stock benefits, or the personal use of a corporate vehicle. It also does not include dividends paid to owner managers.

- An employee’s pre-crisis or “baseline remuneration” is the average weekly eligible remuneration paid to an employee during the period between January 1 and March 15, 2020. Any period of 7 or more consecutive days for which the employee was not paid is excluded from this calculation.

- Remuneration paid to new employees during the qualifying period is eligible provided the employee is dealing at arm’s length.

Eligibility Requirements for the 75% Subsidy

- Eligible employers with a minimum 30 percent decline (15% for March 2020) of their “qualifying revenue” in their “current reference period” vs. their “prior reference period” (see table below).

- Eligible employers may elect to use the average of their qualifying revenue for January and February 2020 as their prior reference period for all claim periods.

- Must have a CRA payroll remittance account on March 15, 2020.

- An employer’s revenue for the purpose of the CEWS is the inflow of cash or receivables in the ordinary activities of the corporation – generally from the sale of goods, or rendering of services – in Canada.

- Revenue must be determined in accordance with the employer’s normal accounting practices.

- For the purposes of the CEWS, employers may calculate revenue using cash basis or accrual accounting, however, once a method is chosen, it must be used for all periods.

- Revenue must be earned from arm’s length sources, and excludes revenue from extraordinary items, and on account of capital.

- For complex structures:

- If a group of eligible entities normally prepare consolidated financial statements, each entity in the group may determine revenue separately.

- Eligible entities in an affiliated group may jointly elect to determine revenue on a consolidated basis. This is an all or nothing rule. Any company that is determined to be a member of an affiliated group, regardless of whether it is a separate division or business, must be included in the consolidated revenue calculation.

- For an employer earning revenue from a non-arm’s length entity, a joint election will permit the employer to base eligibility on the non-arm’s length entity’s revenue. This could apply to groups that centralize payroll in one company.

The individual responsible for the financial activity of the employer will be required to formally attest to the completeness and accuracy of the application.

Eligible Periods

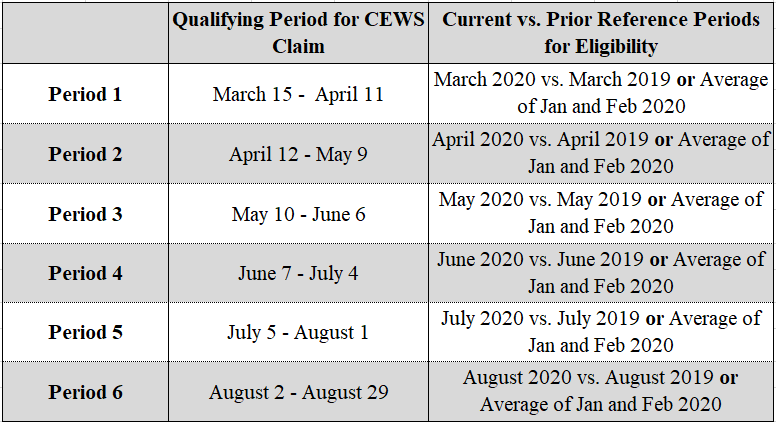

- The table below shows the qualifying periods for CEWS along with the current and prior reference periods to be compared in determining whether there is a minimum 30% decline in revenue (15% for period 1).

- Qualifying in a period results in automatic qualification for the following period. For example:

- An employer that qualifies in period 1 will automatically qualify for period 2;

- However in order to qualify in period 3, the employer must reapply, and qualify in period 2 or period 3.

- Eligible employers that were not in business on March 1, 2019 must use the average of January and February 2020 method. Other employers may elect to use this method for the duration of the program.

- The Government has the option to extend the program till September 2020.

The Application Process

- The online application process opened on the 27th of April.

- Employers can apply through Canada Revenue Agency’s “My Business Account”

- For employers unable to register for My Business Account, a separate online application is also available. An online web access code will be needed to use this alternative application process.

- Employers can expect to receive the subsidy within a relatively short time after their application has been processed. Direct deposit should be set-up to ensure funds are received as soon as possible.

- Employers with more than one CRA payroll (RP) account will need to file a separate CEWS application for each RP account.

- For employees who have collected the Canada Emergency Response Benefit (CERB) payments in error, i.e., the employer has restored an employee’s wage prior to 14 consecutive days without remuneration, the CERB can be repaid using your CRA My Account, through your online banking portal or via cheque sent by mail.

- The deadline to apply for the CEWS is September 30, 2020.

- The CRA will introduce a process that will enable employers to correct errors or omissions in previously submitted claims.

Preparations Before Applying

- Make sure you are registered for My Business Account and direct deposit.

- Assess whether or not you will be eligible for the CEWS subsidy. Review both the decline in monthly revenues and cash receipts.

- Gather the required information and use the CRA’s online CEWS calculator to determine your expected wage subsidy.

- Assess the operational cash flow or financing needed to fund payroll for employees brought back to work before the CEWS is received.

- As the program has been extended till August 29, 2020, consider deferring your application in order to determine which method or program is most beneficial to you over the duration of the program.

- Employers should ensure payroll records, and monthly revenue calculations and records are available to support their CEWS eligibility.

Important Note

The applications for CEWS will be heavily scrutinized. Fraudulent claims can be subject to fines and even imprisonment. Applicants engaging in artificial transactions to reduce revenue and claim eligibility for CEWS can be penalized in amounts equal to 25% of the subsidy claimed. This is in addition to the penalties applicable under the Income Tax Act.

Get in touch with the team at Syed A. Raza Professional Corporation to discuss your specific situation regarding CEWS.