by adminaccountantcpa | Mar 6, 2019 | Retirement Saving

Why are these changes needed On January 1, 2019, the Federal government started making enhancements to the Canada Pension Plan (CPP). These changes are being made to cope with the increasing number of people who will be retiring in the future without any savings....

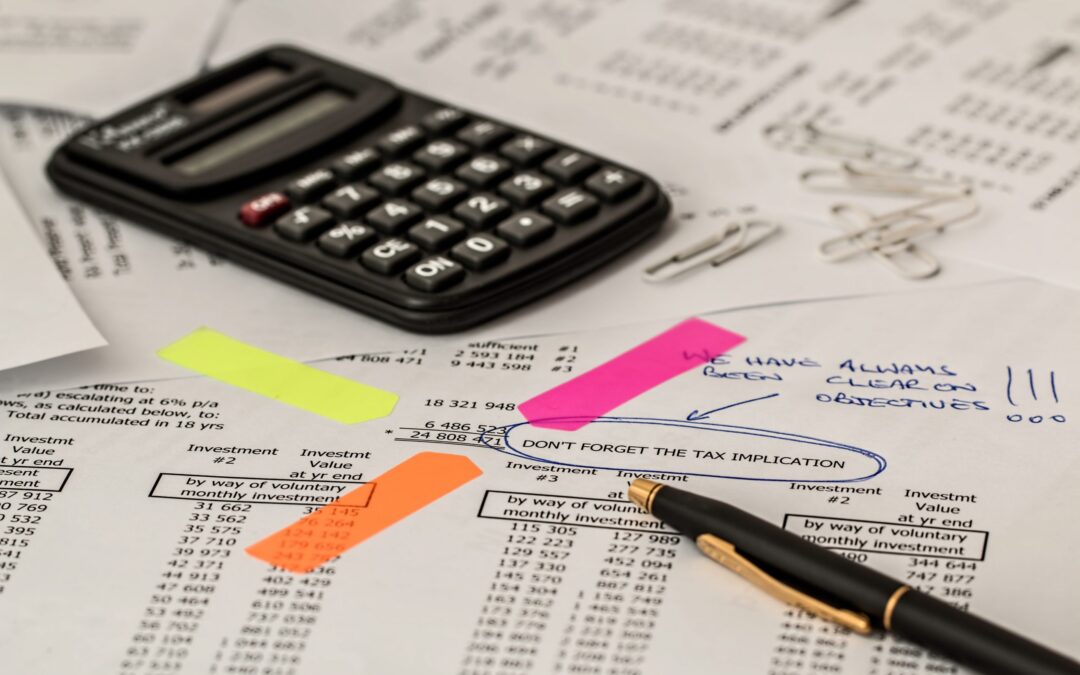

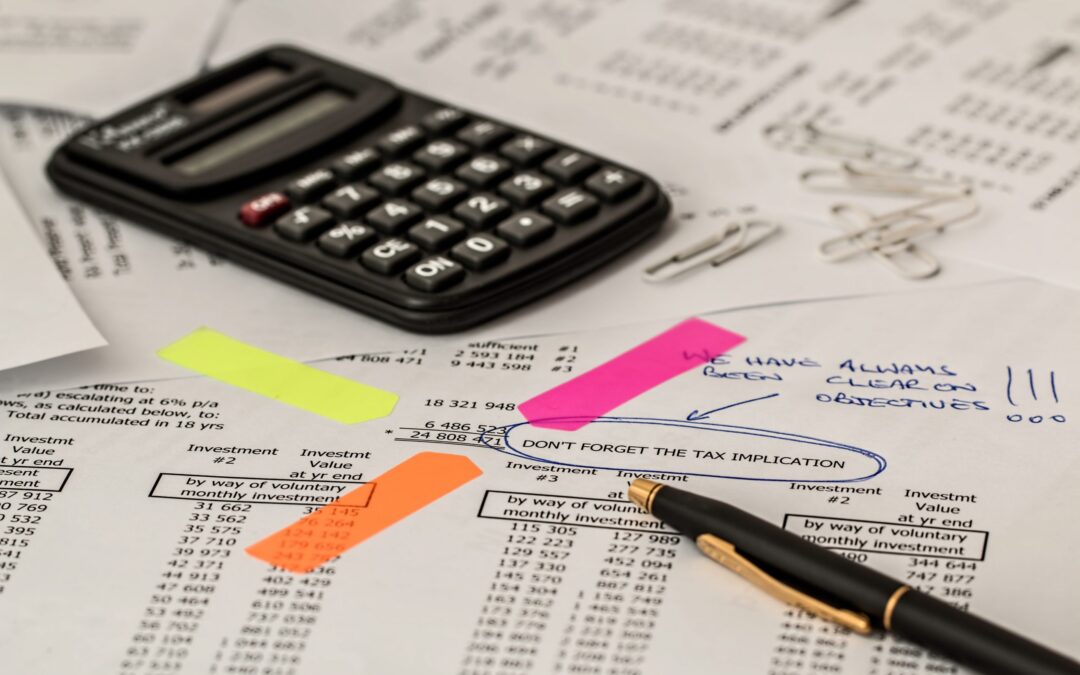

by adminaccountantcpa | Feb 26, 2019 | Medical Professionals, Tax Information

Here are some of the main tax measures which will affect the 2019 tax returns of physicians. 1.Decrease in Small Business Tax Rate As we all know, the Federal small business tax rate decreased from 10% to 9% causing the combined Federal and Ontario small business tax...

by adminaccountantcpa | Jan 30, 2019 | Medical Professionals

Getting right into it, here are the top benefits of incorporating your medical practice. 1. Life Insurance Once you’ve incorporated your practice, you can pay for a life insurance policy directly from the corporation. This is one of the biggest advantages of...

by adminaccountantcpa | Jan 24, 2019 | Retirement Saving, Small Businesses

An IPP is a registered and defined-benefit (DB) pension plan which is usually set up for one person. It provides an added benefit for high-level executives and incorporated business owners. IPP’s are approved by the Canada Revenue Agency (CRA) and offer great savings...

by adminaccountantcpa | Dec 17, 2018 | Tax Information

Having a Tax-Free Savings Account is a great way to invest and earn interest income. However, as with other investment vehicles, there are some tax implications in case of sudden demise of the owner. Here’s a short video explaining some of the more important...